36+ Mortgage calculator for 10 year loan

Fixed interest rate or variable. The most common mortgage terms are 15 years and 30 years.

Amortization Schedule 10 Examples Format Sample Examples

But you may also obtain 20-year 15-year and 10-year terms.

. With a 10-year FRM you only pay 33351 on total interest costs. 20-year mortgages tend to be priced at roughly 025 to 05 lower than 30-year mortgages. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

This shortens their payment duration and helps them save thousands on interest costs. Mortgage loan calculator. Fixed Rate Mortgage Loan Calculator.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgages. Fixed-Rate Mortgages FRM Historically the most widely purchased type of loan is a 30-year fixed-rate mortgage. In the UK and US 25 to 30 years is the usual maximum term although shorter periods such as 15-year mortgage loans are common.

Mortgage payments which are typically made monthly contain a repayment of the principal and an interest element. Press spacebar to show inputs. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower.

Brets mortgageloan amortization schedule calculator. Current 5-Year Hybrid ARM Rates. But with a 30-year FRM your total interest charges amount to 137636.

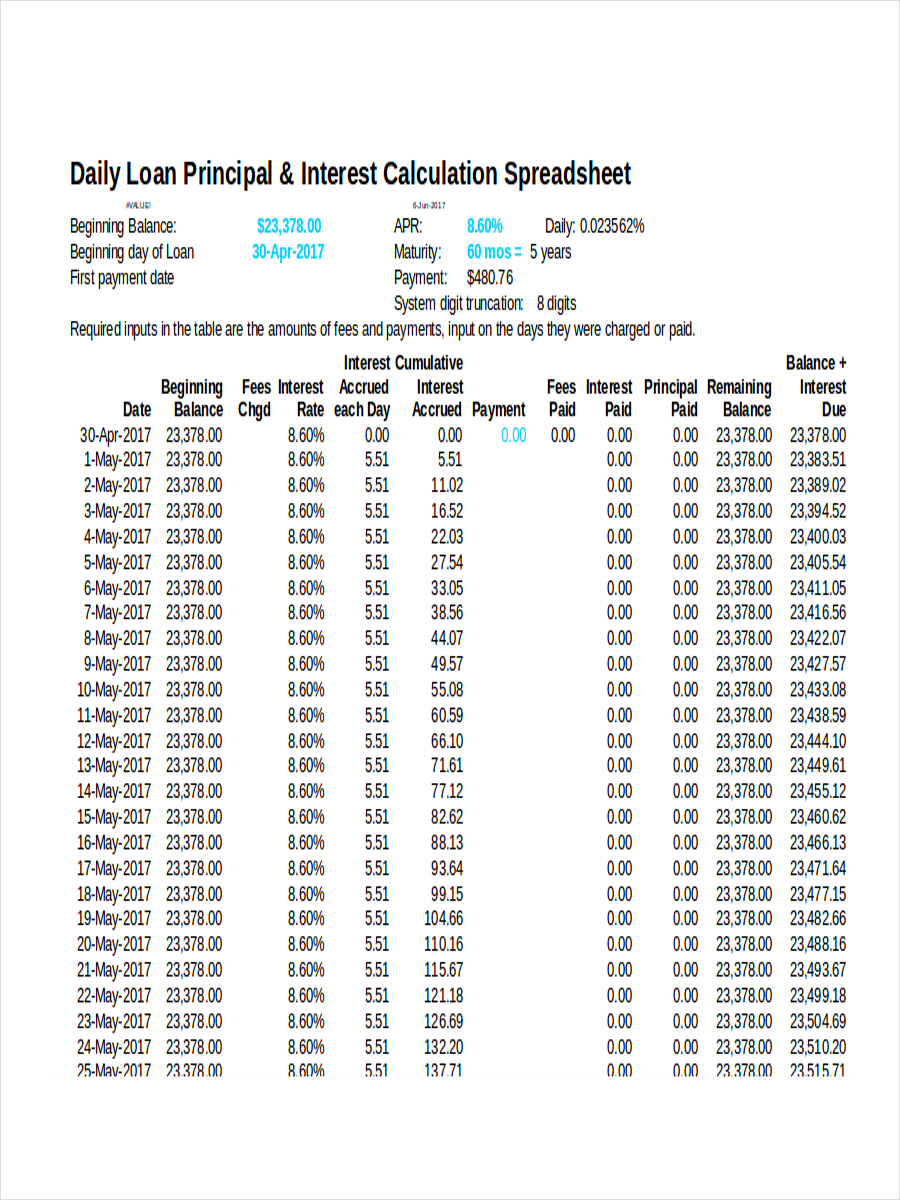

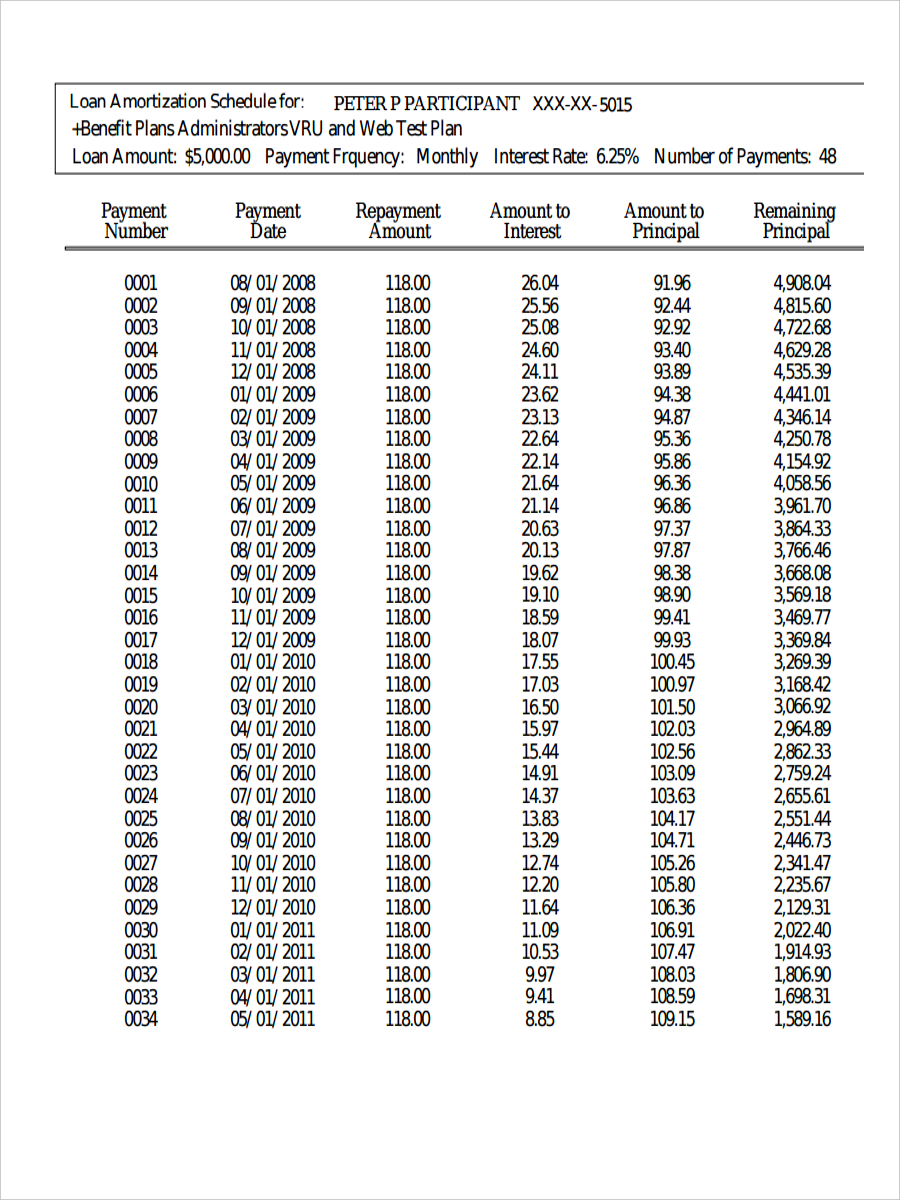

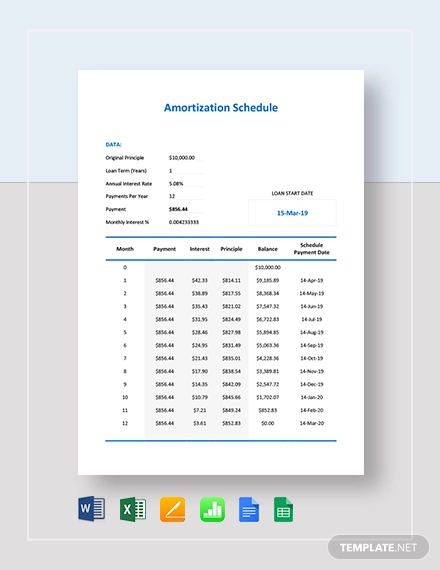

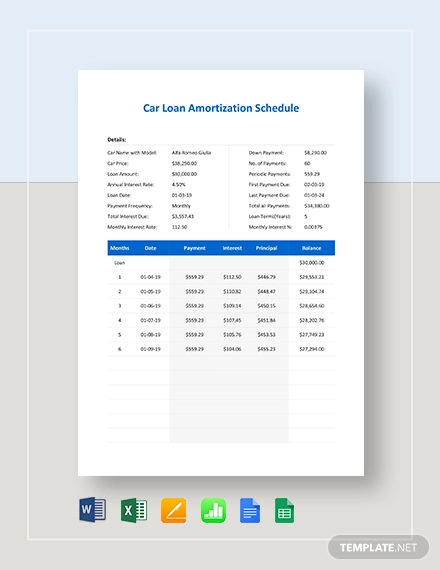

The table shows shorter loan terms generate less interest. Across the United States 88 of home buyers finance their purchases with a mortgage. On a 30-year fixed-rate mortgage that tipping point happens about halfway through the loan term.

Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. Depending on your financial situation one term may be better for you than the other.

See Brets Blog for help. 15 Year Mortgage Calculator 30 Year Mortgage Calculator Condo Mortgage Calculator. Calculate what your mortgage payment will be and how much you can afford.

Everyone who owns real property ie real estate owes property taxes. Begin by entering the desired loan amount expected mortgage rate and loan length in the spaces provided. However savings are more evident when we look at total interest charges.

Name of lender or broker contact information. We provide FREE online consultation to all our visitors. To qualify for a mortgage your DTI ratio should not.

The following table shows the rates for ARM loans which reset after the fifth year. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Using the Mortgage Income Calculator Loan information.

Historical 30-YR Mortgage Rates The following table lists historical average annual mortgage rates for conforming 30-year mortgages. The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. A mortgage loan or simply mortgage.

If your debt payments are less than 36 percent of your pre-tax income youre typically in good shape. As for payment terms the most common ones are 30-year terms. You can use the following calculators to compare 20 year mortgages side-by-side against 10-year 15-year and 30-year options.

Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan. If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on. In a 30-year fixed rate mortgage the interest payment that we make is probably very close to.

This loan calculator is written and maintained by Bret Whissel. Getting ready to buy a home. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

Basic Loan Information Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. For a 15-year conventional loan the average rate. Suppose you need our help on topics like REFINANCING BUYING A HOUSE PROPERTY TRANSFER MORTGAGE INSURANCE LAWYER FEES STAMP DUTY Sale and Purchase Agreement SPA Memorandum of Transfer MOT Perfection of Transfer POT.

If you take a 10-year FRM youll save 104285 on overall interest costs. Todays mortgage rates in Georgia are 5909 for a 30-year fixed 5088 for a 15-year fixed and 5290 for a 5-year adjustable-rate mortgage ARM. What do you do.

That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of 4000. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. Should you take out a 15-year mortgage or a 30-year.

This is because loans with longer terms come with cheaper monthly payments. Number of Regular Payments. Calculate loan payment payoff time balloon.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. The number of years over which you will repay this loan. Thirty_year_fix loan at 0000.

185 percent of your loan amount per year billed monthly. Thank you for checking out the article. Bankrates loan calculator will help you determine the monthly payments on a loan.

The share fell from 96 to 66. For example a 30. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page.

Many lenders want this ratio to be less or equal to 36 of the borrowers incomeHowever conventional loans may allow a DTI as high as 43.

2

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Amortization Schedule 10 Examples Format Sample Examples

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

2

Pin On Data Vis

Amortization Schedule 10 Examples Format Sample Examples

Top 10 Myths That Trip Up First Time Home Buyers

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Mortgage Loan Calculator Fha Mortgage Mortgage Amortization Calculator

Amortization Schedule 10 Examples Format Sample Examples

Early Mortgage Payoff Calculator Mls Mortgage Mortgage Payoff Amortization Schedule Mortgage Refinance Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

30 Best Business Accountants Bookkeepers In Richmond Melbourne 2022

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Payoff Pay Off Mortgage Early Mortgage Amortization Calculator